Our Big Why

It started with rethinking a few questions. Question No. 1: Can the megacap tech elephants still dance? Or is this the better question: Is there an alternative and better way to capture long-term investment returns created by disruptive forces and innovation without chasing the highly popular megacap tech stocks, or falling for the "Next-Big-Thing" trap in overpaying for "growth", or investing in the fads, me-too imitators, or even in seemingly cutting-edge technologies without the ability to monetize and generate recurring revenue with a sustainable and scalable business model? How can we distinguish between the true innovators and the swarming imitators?

Question No. 2: What if the “non-disruptive” group of reasonably decent quality companies with seemingly “cheap” valuations, a fertile hunting ground of value investors, all need to have their longer-term profitability and balance sheet asset value to be “reset” by deducting a substantial amount of deferred innovation-related expenses and investments every year, given that they are persistently behind the innovation cycle against the disruptors, just to stay “relevant” to survive and compete? Let’s say this invisible expense and deferred liability in the balance sheet that need to be charged amount to 20 to 30% of the revenue (or likely more), its inexactitude is hidden; its wildness lurks and lies in wait. Would you still think that they are still “cheap” in valuation?

Consider the déjà vu case of Kmart vs Walmart in 2000s and now Walmart vs Amazon. It is easy to forget that Kmart spent US$2 billion in 2000/01 in IT and uses the same supplier as Walmart – IBM. The tangible assets and investments are there in the balance sheet and valuations are “cheap”. Yet Kmart failed to replicate to compound value the way it did for Walmart. Now Walmart is investing billions to “catch up” and stay relevant. Key word is “relevancy” to garner valuation.

We now live in an exponential world, and as the Baupost chief and super value investor Seth Klarman warns, disruption is accelerating "exponentially" and value investing has evolved. The paradigm shift to avoid the cheap-gets-cheaper "value traps", to keep staying curious & humble, and to keep learning & adapting, has never been more critical for value investors. We believe there is a structural break in data in the market’s multi-year appraisal (as opposed to "mean reversion" in valuation over a time period of 2-5 years) on the type of business models, the “exponential innovators”, that can survive, compete and thrive in this challenging exponential world we now live in. Tech-focused innovators with non-linear exponential growth potential are the most relevant multi-year investment trend and opportunity.

During our value investing journey in the Asian capital jungles over the decade plus, we have observed that many entrepreneurs were successful at the beginning in growing their companies to a certain size, then growth seems to suddenly stall or even reverse, and they become misguided or even corrupted along the way in what they want out of their business and life, which led to a deteriorating tailspin, defeating the buy-and-hold strategy and giving currency to the practice of trading-in-and-out of stocks. On the other hand, there exists an exclusive, under-the-radar, group of innovators who are exceptional market leaders in their respective fields with unique scalable business models run by high-integrity, honorable and far-sighted entrepreneurs with a higher purpose in solving high-value problems for their customers and society whom we call H.E.R.O. - “Honorable. Exponential. Resilient. Organization.”.

The H.E.R.O. are governed by a greater purpose in their pursuit to contribute to the welfare of people and guided by an inner compass in choosing and focusing on what they are willing to struggle for and what pains they are willing to endure, in continuing to do their quiet inner innovation work, persevering day in and day out.

There's a tendency for us to think that to be a disruptive innovator or to do anything grand, you have to have a special gift, be someone called for. We think ultimately what really matters is the resolve — to want to do it, bring the future forward by throwing yourself into it, to give your life to that which you consider important. We aim to penetrate into the deeper order that whispers beneath the surface of tech innovations and to stand on the firmer ground of experience hard won through hearing and distilling the essence of the stories of our H.E.R.O. in overcoming their struggles and in understanding the origin of their quiet life of purpose, who opened their hearts to us that resilience and innovation is an art that can be learned, which can embolden all of us with more emotional courage and wisdom to go about our own value investing journey and daily life.

When Bill Gates was asked in an interview “what it takes to build a Microsoft, or to build an Apple, or to build a Facebook”, his reply was unequivocal: “I think the world's best companies are built by fanatics.” When pressed “what does fanatical mean?”, Gates said poignantly, “Work day and night. Sort of don't worry about the possibility of failure. Every setback is just something to work a little bit harder at doing. We live in an age when people want a quick fix, a shortcut to exceptional results. But there is no such easy path. There is only an intense, long-term, sustained effort. And the only way to build that kind of enterprise is to be fanatic. Such obsessed people do not become the most popular people, as they often intimidate others, but when fanatics come together with other fanatics, the multiplicative effect is unstoppable.”

Our H.E.R.O. Innovators have something in common – they witnessed first-hand the problems that beset the masses and wanted to build a business to provide useful products and services. They want to build and scale their businesses so that they can give more. Only when we have the desire to give, then can we want to persevere in building something meaningful. This urge to build in order to give is their True North to scale the business and they work obsessively to realize this vision. Our H.E.R.O. is a fanatic with PQ (Purpose Quotient), remaining unwavering in her commitment to an idea larger than oneself in service of others, and OQ (Obsession Quotient), the focus, intensity, conscientiousness and discipline towards her craftsmanship. In service of others, she may use her powers to be good and do good even as she struggles with exhaustion. She may live with incredible alienation even as only relationships can save her. It’s a never-ending battle.

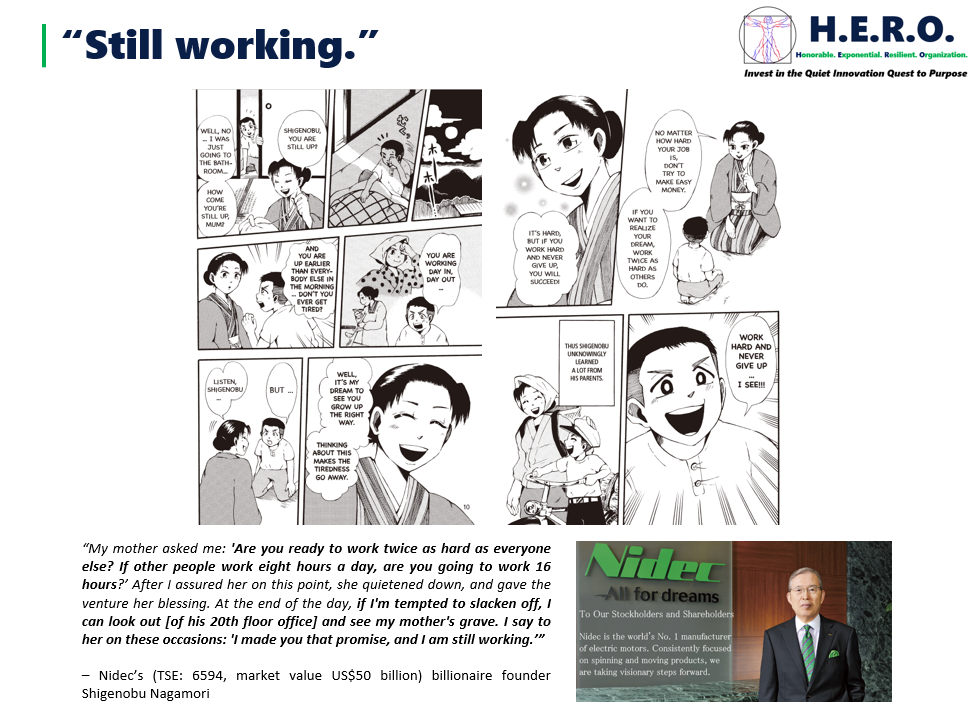

An inner battle that never ends even if one achieves phenomenal success, like in the case of billionaire Shigenobu Nagamori, founder of Nidec Corp (TSE: 6594), the world’s #1 manufacturer of electric motors, which compounded 5,000% since 1992 to a market value of US$50 billion. Nagamori-san recounted his story when he told his mother that he is starting his own business: “My mother asked me: 'Are you ready to work twice as hard as everyone else? If other people work eight hours a day, are you going to work 16 hours?’ After I assured her on this point, she quietened down, and gave the venture her blessing. At the end of the day, if I'm tempted to slacken off, I can look out [of his 20th floor office] and see my mother's grave. I say to her on these occasions: 'I made you that promise, and I am still working.’”

If you identify yourself in the values and bigger sense of purpose in the H.E.R.O., or you wish to tell from your heart to your most important person, son, daughter, wife, husband, or best friend that you are an intrepid explorer in the H.E.R.O.’s journey participating in the long-term exponential growth of the H.E.R.O., standing up for the embracement of the human spirit, please contact us via email or Whatsapp. We look forward to open up a meaningful conversation with you to explore the H.E.R.O.'s journey together.

Warm regards,

KEE Koon Boon ("KB")

KB Kee | [email protected] | Whatsapp: +65 9695 1860

Our Story: Why We Believe & Care Deeply In H.E.R.O.

(1) Never Stop Exploring: We Want to Discover, Tell – and Invest In! - The Evergreen Stories – of Emerging Innovators Who Are Willing to Sacrifice to Make Significant Contributions

What is your own vision of the future?

Especially when there is no funding for the venture. No government grants. No high-level connections.

Yet, how did the Wright brothers succeed where a better-equipped, better-funded, and better-educated team led by the highly-regarded Samuel Pierpont Langley, whose friends included some of the most powerful men in government and business such as Andrew Carnegie and Alexander Graham Bell, could not?

Both the Wright brothers and Langley were highly motivated. Both had a strong work ethic. Both had keen scientific minds. They were pursuing exactly the same goal, but only the Wright brothers started with Why. They knew Why it was important to build the flying machine. They believed that if they could figure out this flying machine, it could change the world. They imagined the benefits to everyone else if they were successful. The Wright brothers were true scientists, deeply and genuinely concerned about the physical problem they were trying to solve – the problem of balance and flight. Langley, on the other hand, was consumed with acquiring the level of prestige of his associates like Alexander Graham Bell, fame that he knew would come only with a major scientific breakthrough. Langley did not have the Wrights’ passion for flight, but rather was looking for achievement. One was motivated by the prospect of fame and wealth, the other by a belief. The Wright brothers excited the human spirit of those around them.

The first and primary motive to Why H.E.R.O. is conceived and born is because we want to discover, to tell – and to invest in - the stories of the overlooked and underappreciated emerging innovators like the Wright brothers - in Asia. We believe that the future and innovation – and multi-bagger investment returns - happens at the edges by the misfits, the outcasts, the underdogs who forged an original – but extraordinarily difficult – path. Those who make the difficult choice to champion for and stay true to ideas and values larger than themselves, a greater purpose and cause that go against the grain and go the extra mile and are willing to sacrifice to make significant contributions, inspiring those around them.

H.E.R.O. Innovators have something in common – they witnessed first-hand the problems that beset the masses and wanted to build a business to provide useful products and services. They want to build and scale their businesses so that they can give more. Only when we have the desire to give, then can we want to persevere in building something meaningful. This urge to build in order to give is their True North to scale the business and they work obsessively to realize this vision.

We want our investors to be proud of having ownership in inspiring H.E.R.O. Innovators in their pocket who are Honorable and High-Integrity with a Higher Purpose in solving High-Value Problem for their targeted customers and society, as captured by the essence of the first letter H of the H.E.R.O. And that they are discovered at an earlier or tipping point stage as a small- and mid-cap company. And that H.E.R.O. stands for the embracement of the eternally misunderstood human spirit unleashing her technological and innovative capacities without any reserve, realizing her societal mission and working to her heart's content.

(2) Stop Fearing: Defang The Risky Bite of the “Next Big Thing” Trap, Especially With Prevalent Asian-Style Accounting Fraud & Misgovernance Risks

Caring is an exacting, serious and demanding business, especially when it comes to being entrusted to invest in another person’s financial assets, which represent much more than money – they are a tangible product of one’s life’s work and a repository of aspirations for the future.

As a fund manager and educator in the Asian capital jungles, I have been reading, listening to and analyzing stories of entrepreneurs for over 15 years, including witnessing many investors and friends who had invested their hard-earned savings in a number of these supposed value stocks which are thematic stocks that are part of the popular mantra "Ride the Asian Growth Story!", only to find themselves subject to emotional upheavals when these stocks turned out to be inherently sick and prey to economic vicissitudes. They may seem to grow faster initially but the sustainable harvest of their returns is far too uncertain to be the focus of a wise program in investment.

Worse still, some turned out to be involved in accounting frauds, in which their financial numbers were “propped up” artificially to lure in more funds from investors, and the previous assessed asset value had already been “tunneled out” or expropriated in money-go-round tunneling opportunities via unusual related-party transactions. The four categories of commonly-used tunneling methods used by actual insiders, manipulators and syndicates to expropriate corporate assets include: (1) Money-go-round intercorporate loans, guarantees, other receivables and investments, (2) Capex irregularities, (3) Deals potion, (4) Consolidation craftiness e.g. the improper pushing of operating expenses and debt liabilities into unconsolidated entities in which the listco has effective economic control and power to artificially inflate its own profit and balance sheet asset value. This issue is compounded as western-based fraud detection tools and techniques have not been adapted to the Asian context to avoid these traps. It is disheartening to witness many fraud perpetrators go away scot-free and live a life of super luxury on these unsuspecting minority investors’ hard-earned money.

Thus, accounting information can be used to inform – or to deceive. I am fortunate to have taught accounting at the SMU, including launching the inaugural 15-weeks course Accounting Fraud in Asia. I am grateful to be invited by Singapore’s financial regulator Monetary Authority of Singapore (MAS) to present to their top management team about the potential of implementing the world’s first fact-based fraud detection system for Singapore. I incorporated and implemented this fact-based forward-looking fraud detection system that combines accounting data, especially footnotes, with a wide array of contextual information - including unusual related-party transactions; money-go-round off balance-sheet activities; governance, group structure, consolidation accounting and ownership analysis; textual and linguistic analysis; analysis of event-based “catalysts” (information-based manipulation) and sensitive market announcements (action-based manipulation in prices and volume) - to provide fresh insights in equity valuation.

An overarching purpose of H.E.R.O. is to help our investors defang the risky bite of the “Next Big Thing” trap of investing in fads, me-too imitators, cash-burning tech companies, or even in seemingly cutting-edge technologies without the ability to monetize and generate recurring revenue with a sustainable and scalable business model, helping our investors to know how to distinguish between the true innovators and the swarming imitators, between the devoted missionaries forging a greater purpose and the promotional arbitrage-based mercenaries.

(3) Never Stop Learning - Value Investing 3.0, A Paradigm Shift In Investing In An Exponential World - From "Stalwarts" to "H.E.R.O. Innovators"

“Every fund manager, even the good ones, will go through ups and downs. And the test is whether he or she can be trusted to keep learning to adapt and win with the right values in managing money.”

This is what a wise business owner of a highly successful European asset management group with over 3 billion euros in asset under management – and one of our H.E.R.O. clients – shared with us when he entrusted his capital with H.E.R.O. Reflecting on my decade-plus of learning in the investments industry, I am deeply grateful to clients, friends and partners who have trusted me to do the right thing in winning for them.

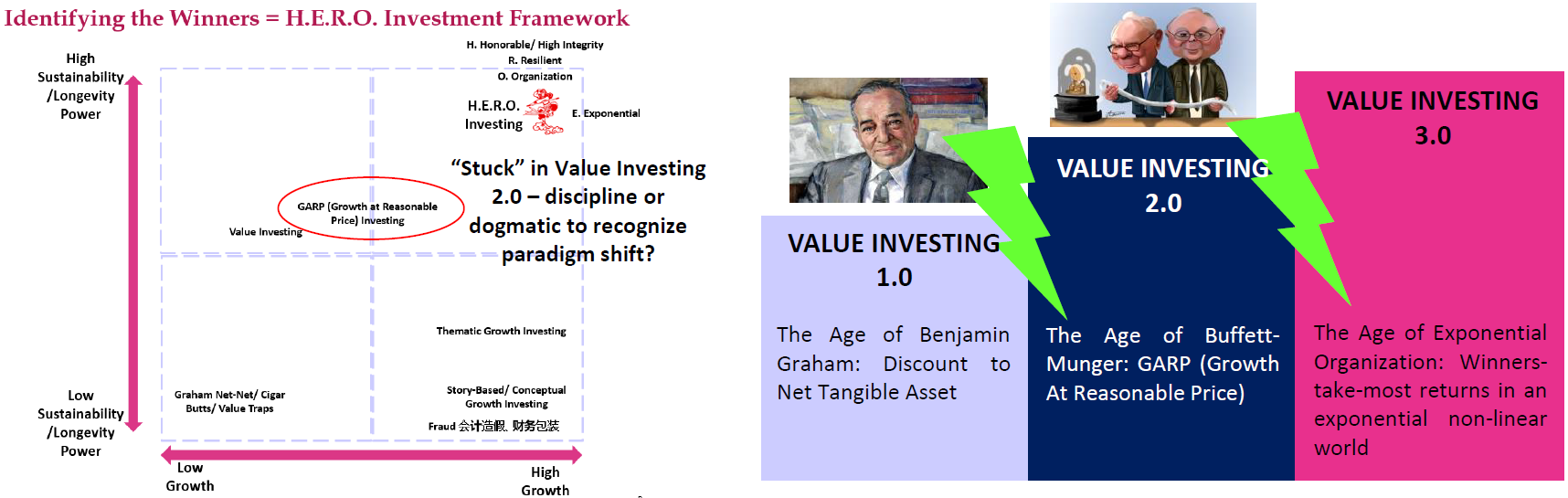

Charlie Munger, the influential partner to Warren Buffett, commented this about Buffett: “Warren Buffett has become one hell of a lot better investor since the day I met him, and so have I. If we had been frozen at any given stage, with the knowledge we had, the record would have been much worse than it is. So the game is to keep learning, and I don't think people are going to keep learning who don't like the learning process. If you keep learning all the time, you have a wonderful advantage.” Value Investing 1.0 as epitomized by Benjamin Graham’s discounted net-net tangible asset value approach was disrupted by Value Investing 2.0 led by Charlie Munger. Charlie Munger's contribution was to nudge Warren Buffett towards 'the direction of not just paying for bargains', as was taught to Buffett by Benjamin Graham. As Buffett elucidated: “It took a powerful force to move me on from Graham's limiting view. It was the power of Charlie's mind. Boy, if I had listened only to Ben, would I ever be a lot poorer; I became very interested in buying a wonderful business at a moderate price.”

Consider this quote from Barron’s (17 March 2018): “We don’t own Amazon.com because we can’t justify its valuation on cash flow, earnings, book value, sales revenue, you name it,” says Bill Nasgovitz, manager of the $786 million Heartland Value fund. “It just doesn’t fit.” On the other side of the aisle is mid-cap growth fund manager Michael Lippert, who has a 7% weighting in Amazon (AMZN) in his $308 million Baron Opportunity fund. Value investing is a lost cause in today’s high-tech, winner-take-all economy, according to Lippert. “The world we live in today—it’s haves and have-nots, and there are way more have-nots,” he says. “There are so many industries being disrupted by the digitization of the world; it’s hard to make cyclical bets on have-not value stocks.”

How should one invest in an exponential world? It appears tough to be in either camps as described above.

Having delivered outperformance for clients over my investments career from investing in SMID-cap "stalwarts" which demonstrate resilient 10-25% CAGR profit growth, including a double-digit fund return in 2016 when markets were negative, I noticed there is a distinctive tidal shift in valuation premium towards mega-cap tech stocks from 4Q2016 onwards, a trend which has quietly spilled over to tech-focused innovators.

If Buffett was nudged by Munger to recognize a paradigm shift to Value Investing 2.0, I was nudged by various examples and investment errors to recognize that we are now in Value Investing 3.0, the age of the Exponential Organization in which we are still early in the mega trend of tech-focused innovators.

(4) Never Stop Contributing & Sapere Vedere

When asked for his secret, Leonardo da Vinci would characteristically respond with the phrase he conceived and adopted as his personal motto: Sapere vedere. The phrase combines the Latin “sapere”, which means knowing how, and “vedere”, which means to see. Sapere vedere is knowing how to see. People with sapere vedere look forward as well as inward; they are capable of believing and seeing what others don’t. Knowing how to see, is crucial to living a life of significance.

Sapere vedere is three dimensional, a combination of hindsight, foresight and insight. Hindsight is seeing back. Hind is behind. It’s where we’ve been. Foresight is seeing ahead. Fore is before. It’s what is in front of us. Insight is seeing from within. It’s what we see with the eyes of our mind and feel with the pulse of our heart. As Myles Munroe writes in his book The Principles and Power of Vision, “Sight is a function of the eyes, vision is a function of the heart… Vision sets you free from the limitations of what the eyes can see and allows you to enter into the liberty of what the heart can feel. Never let your eyes determine what your heart believes.” Wisdom is knowing what we saw. Vision is knowing what we see. And sapere vedere is knowing how to see. By focusing on what’s within our heart and mind, and looking ahead, vision pulls us forward. With vision, people look ahead with confidence. Confidence means to go with faith. Clear vision allows us to proceed with faith in ourselves.

And Purpose is an all-important ingredient for sapere vedere. Once we know our purpose, we become pathfinders. Knowing what we want to do dictates where we go and where we put our focus. Our path is the way we travel. Our vision is where we travel. Our purpose is why we travel. Da Vinci said, “May your work be in keeping with your purpose.” Think of Gandhi who saw a free India. It didn’t matter that no one else did. He did.

Those who pursue their vision have had to endure something difficult, something trying. As we walk our path and see to fulfil our purpose, we will inevitably have disappointments that knock us down. However difficult, being able to see what is ahead unleashes the ability to persevere and prevail.

Stephen Covey has a personal motto that serves to keep his vision clear. That motto: Live life in crescendo. “To live life in crescendo is to constantly look forward. It means your greatest work, and contribution, is always ahead of you. The philosophy places the emphasis on contribution. While achievement has a beginning and an end, contribution is ongoing and enduring. If you focus on contribution and not on achievement, you will achieve more than your wildest dreams.

To our clients, friends and partners, we are thankful and grateful for your sapere vedere, trust and support in us as we invest in H.E.R.O. Innovators in crescendo together.

Please feel free to contact us with any questions, thoughts or comments at: [email protected].

Warm regards,

KB